The Future of Corporate Sustainability: Insights from the 12th GRAM Partnership Webinar on Europe’s New Corporate Sustainability Directive

In 2019, the Independent Redress Mechanism (IRM) launched the Grievance Redress and Accountability Mechanism (GRAM) partnership. This initiative was designed to offer leadership, learning platforms, and spaces for emerging GRAMs across various sectors. Over time, it has become a vital hub for discussions on grievance redress issues, corporate responsibility, and stakeholder engagement.

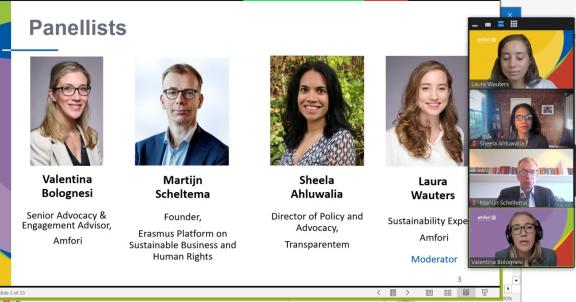

On September 9, 2024, the GRAM partnership held its 12th webinar, bringing together sustainability experts to discuss one of the most transformative regulations in the corporate world: the European Corporate Sustainability Due Diligence Directive (CSDDD). Hosted by Amfori—Trade with Purpose, the session delved into the future of corporate sustainability and the impact of the newly adopted CSDDD. Moderated by Laura Wauters, a sustainability expert at Amfori, the discussion provided a detailed examination of how businesses will be affected by the directive, especially in terms of their operations, supply chains, and environmental and social governance (ESG) strategies.

A New Era of Corporate Due Diligence

CSDDD The European Council’s formal adoption of CSDDD in May 2024 represents a significant step toward standardising ESG practices across Europe. The directive aims to foster corporate accountability by requiring companies to conduct rigorous due diligence throughout their operations and supply chains. This includes assessing potential adverse impacts on human rights and the environment, with an emphasis on ensuring transparency and accountability.

The Role of Risk-Based Due Diligence

Valentina Bolognesi, representing Amfori’s Sustainable Business Initiative, kicked off the webinar with an exploration of how the CSDDD will apply to both EU and non-EU companies operating in the European market. She underscored the importance of risk-based due diligence, noting that the directive builds on international standards, requiring businesses to assess and address the risks of adverse impacts on human rights and the environment.

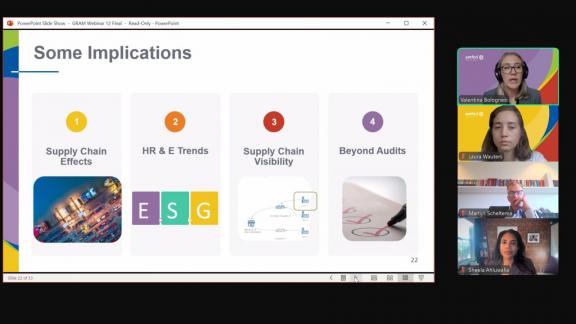

A key takeaway from Bolognesi’s presentation was the directive's impact on corporate management systems. Companies will need to prioritise adverse impacts and set up mechanisms for receiving complaints and addressing grievances. Additionally, EU companies are expected to adopt climate transition plans, aligning their strategies with global climate goals.

However, Bolognesi highlighted the challenges of companies assessing risks and impacts, particularly around the scope and depth of their assessments. These challenges may affect the way businesses manage and mitigate their adverse impacts, and ultimately, how they navigate the requirements of the directive.

Strengthening Stakeholder Engagement and Accountability

The second intervention came from Martijn Scheltema, founder of the Erasmus Platform on Sustainable Business and Human Rights. Scheltema focused on the implications of CSDDD for corporate engagement with external stakeholders.

One of the directive’s core requirements is that companies must communicate their due diligence efforts to public supervisors, who will have the power to investigate non-compliance (Article 25). Supervisors can issue orders to provide remedy, a shift in the traditional role of supervisors in most EU member states, where they typically enforce broader regulatory measures rather than individual company-specific remedy.

Scheltema also discussed Article 26, which allows anyone to raise concerns when they believe that a company is not fulfilling its obligations. This is a notable departure from previous standards, as it enables greater public oversight and involvement in corporate accountability processes.

Navigating Supply Chain Transparency and Accountability

Sheela Ahluwalia, director of policy and advocacy at Transparentem, contributed to the discussion by highlighting the challenges of corporate sustainability accountability, particularly within global supply chains. Drawing from her organisation’s investigations into corporate abuses, Ahluwalia pointed out that many companies do not fully disclose their supply chain activities, leading to significant transparency gaps.

Ahluwalia emphasised the added value of CSDDD, which will require companies to map their entire supply chain, integrate due diligence into company policy, and scrutinise their procurement and purchasing practices. Companies will also need to follow clear guidelines for audits, and the directive mandates the establishment of grievance redress mechanisms. Importantly, anyone, including anonymous whistleblowers, will be able to file complaints through these mechanisms.

Conclusion

A New Era of Corporate Sustainability The 12th GRAM webinar offered invaluable insights into the future of corporate sustainability under CSDDD. The directive, set to come into full effect by 2027, marks a turning point for EU businesses and business operating in Europe. However, the discussions also revealed potential challenges. One pressing concern is the extent to which companies in developing countries, particularly those in EU supply chains, may bear the cost of due diligence measures. This raises questions about the directive’s broader economic implications, particularly for businesses in the Global South that risk exclusion from the global economy.

Ultimately, the webinar sparked thoughtful discussions on the future of corporate sustainability, highlighting the need for continued dialogue on how to ensure that the directive’s benefits extend beyond Europe’s borders.

Stay Updated

For more information on GRAM-related activities and updates on corporate sustainability, follow IRM’s social media accounts and stay engaged with the latest developments in corporate accountability.